What is a decision and what unifies all those things that we call decisions?

Think about this phrase – All decisions are investment decisions.

We tend to think about the concept of investment as being about the allocation of that scarce resource – money, and money is definitely one of the significant scarce resources that we allocate. However, money is not the only scarce resource that we allocate in the decision-making process.

The great scarce resource that we all have the same amount of is time. Sometimes measured in hours, minutes and seconds, sometimes in our degree of attention, passion or dedication to something. Our degree of comfort, our health, our wellness, sometimes even our own lives is the scarce resources that we may be putting on the line or investing in an opportunity.

One big scarce resource, particularly when we’re making decisions in an organisation, particularly when the subject of innovation is concerned, is that scarce resource of reputation.

We don’t measure this scarce resource of reputation in terms of pounds, euros or dollars, but we certainly have a sense of what it might be like to gain more of it, or what it might be like to lose it.

All decisions are investment decisions.

An economist’s definition of a decision is ‘the allocation of scarce resources under conditions of uncertainty’.

Let’s think about risk-taking. You may have identified some risks that you have taken, maybe taking that employment opportunity or promotion? That was a big risk because you didn’t know how it was going to work out.

Maybe it was a physical risk, such as jumping out of an aeroplane or making a bungee jump? What unifies all of these particular risks?

Well, when we think about standing here in our comfort zone and looking at the risk or opportunity, what usually unifies risks and why we define them as risk, is that they represent a greater potential for loss – for a downside.

Jumping out of the aeroplane could lead to a potential loss of life and going for that promotion could be a potential loss of reputation.

We’d be crazy to do anything, where the only possibility, the only outcome, was a downside.

What must also unify all the risks that we could potentially take is a greater potential for gain – for upside.

All decisions are investment decisions, and all risks are kinds of decisions with a greater potential for loss than staying in the comfort zone and a greater potential for gain.

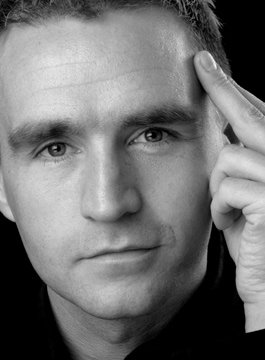

Risk Taking and Decision Making Speaker

Caspar Berry is one of Europe’s leading keynote speakers on the topics of Risk and Decision Making.

For more information or to book Caspar to present a webinar or to speak at a future event, please contact us or visit Caspar’s profile.